Belgium

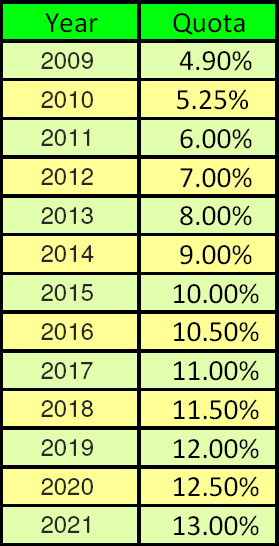

In Belgium are two supporting instruments. The major one is quota system which based on quota obligation, tradable certificates and minimum and maximum prices. Income tax reduction as a fiscal regulation mechanism, is additional instrument which supports geothermal and solar technologies. [54] In the quota system, energy suppliers present that consumers from certain region (in Belgium are three regions: Wallonia, Flanders, Brussels City) are supplied by the green energy and then the regional regulatory authority allocates green certificates. One certificate is gained per 1 MWh of the green energy which was supplied to consumers. To be supported by that instrument the operator system has to be authorized (if obtains certificates of origin). Moreover in case of wind, tidal and wave technologies the special license from responsible ministry is required. Offshore power plant are eligible to receive support only for federal schemes. Special requirements are also for biomass power plants which combust wastes. Total energy content have to equals 35% or more. Hydro systems are supported only if their capacity equals or exceed 10MW of capacity. Support is eligible only for national projects and is statutory basis. In each region the quota is different. Following figure shows the quotas in Flanders (Fig. 55). [54]

Moreover there are also minimum payment for several technologies: [54]

- For offshore farms witch capacity up to 216 MW minimum payment equals 107 €/MWh plus 90 €/MWh per each MW above 216 MW. [54]

- For onshore farms and hydro power plants minimum payment equals 50 €/MWh. [54]

- For solar power plants minimum payment equals 150 €/MWh. [54]

- For other technologies (including bio technologies) minimum payment equals 20 €/MWh. [54]

In Belgium the RES technologies have priority in grid connection which is ensured by contract. The grid operator is responsible for electrical network upgrading however all decisions have to be planed with the "Direction genérale de l’Energie“ and the "Bureau fédéral du plan“. [54] Regulation requirements in Belgium are Act on the Organisation of the Electricity Market of 29th April 1999 (Loi du 29 avril 1999), Decree of the Flamish Government on the Promotion of Renewable Electricity Generation of 5th March 2004 (Besluit van 5 maart 2004), Royal Decree on the Introduction of Mechanisms Promoting Renewable Electricity Generation of 16th July 2002 (Arręté royal du 16 juillet 2002), Decree of the Flamish Government on the Organisation of the Electricity Market (Decreet van 17 juli 2000), Income Tax Code of 10th April 1992 (CIR 92). [54]

-

Description of technology|

Economic aspects|

Environment and public awareness|

Legislation|

Final comparison|

References