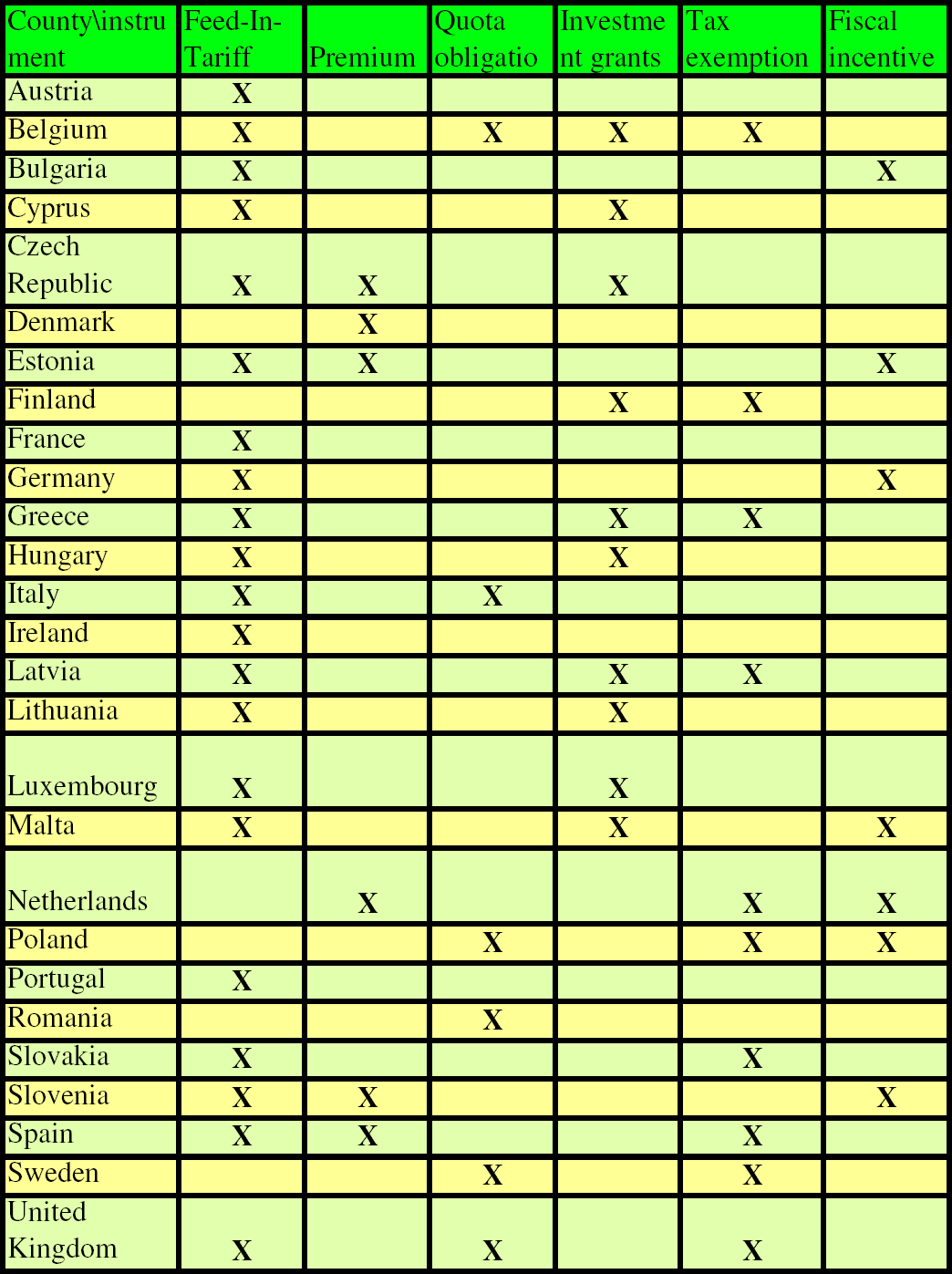

Instruments of the RES technologies support in the EU

The EU introduced six categories of the RES supporting instruments: feed-in tariff, premium, quota obligation, investment grants, tax exemptions and fiscal incentives.

Feed-in tariff

The First one, feed-in tariff is a major supporting instrument, used in the EU for many years. That system operates in the following Member States: France, Germany, Spain, Greece, Ireland, Luxembourg, Austria, Hungary, Portugal, Bulgaria, Cyprus, Malta, Lithuania, Latvia and Slovakia. Although all of them used mentioned instrument, there are many difference between details in each country and usually they are different for each technology. Exceptions are Cyprus and Estonia where there are common tariff for all technologies. In that system producer does not sell energy on market but to the single buyer like the TSO and is not stimulated by the energy price signals. [43] The major advantage of feed-in tariff is that supports investment in long term with fixed level. It decrease investment risk considerably. The observation shows that in countries which established that system, investment costs are significantly lower. Therefore the risk of future returns are also much lower. Moreover operation costs are also not so high compared with other instruments due to guaranteeing the price and proving security demand. Thus there is no market risk and ensure certainty for the investors regarding the rate of return of a project. Due to the energy prices of energy for the end consumer. [43] The level of tariffs is based on future expectations of the generation cost. If this is overestimate the final price for the end costumers are higher and the producers receive a windfall profits. Therefore usually tariffs are reviewed regularly, adjust to the latest available generation cost projections and to stimulate technology learning. Often payments are guaranteed for a limited period to avoid windfall profits over the lifetime of the power plant and allows to recovery of the investment. [43]

Feed-in premium

That system is relatively new and is provided in Denmark and the Netherlands. Other member states like Spain, Czech Republic, Estonia and Slovakia have introduced that system in parallel with feed-in tariffs, giving the producers possibility to choose between both instruments. It also existed with different form in each country. In that system compared with feed-in tariffs the risk of return are less predictable. Therefore the total costs of capital are higher. [43] The level of tariffs is based on future expectations of the generation cost and the average electricity market revenues. Then also here (like in before described system) if the production costs are overestimated or if the prices are underestimated, the final price of energy for consumers are higher and the producers obtain windfall profits. To avoid mentioned problem important is to regularly review of cost projection and to regularly adjust premiums. [43] In feed-in premium system, renewable energy producers participate in the whole sale electricity market. Moreover the producer which have fuel cost are stimulated to adjust production according to the price signals on the market. [43]

Renewable and quota obligation

That instrument supports the RES development in such countries as: Belgium, Italy, Sweden, the UK, Poland and Romania. Listed countries have been obligated to achieve minimum shares of renewable electricity suppliers. If the are not met their commitments, they will have to pay penalties. The value of penalty depends from how much “green energy” they produced. As higher lack of the RES share is, as the level penalty is higher. Expect obligation that system consist of green certificates. The “green energy” producer obtain them for energy gained by the RES and can sell them to amortize relatively high investment cost. That support is instantly and automatically phased out in the moment when the technology become competent on the electricity market. Hence, tradable certificates represent the value of the energy in certain time. However certificates system may provide to lower benefits of existing conventional power plants. With uncertainty about the current and future certificates price increases financial risks for developers, because they are selling produced electricity and related with energy production certificated. That additional risk can have impact on future prices for the final consumers. Quota obligation system has one more serious disadvantage related with type of the RES technologies. There is no apportionment on technology categories (expansive and inexpensive) and there are the same rate for all options. Therefore mature technologies (such biomass combustion or on-shore wind power plants) which investment and operation costs are lower than new and more expansive projects (like marine or solar power plants), will developed faster. Hence the investors of cheap options will earn windfall profits and projects with higher costs are not profitable. Therefore member states such Italy, the UK and Belgium introduced technology and band specifications. That solution allow to steady development of all technologies. If that solution is still not efficient enough, certificate system can be combined with other systems like feed-in tariffs or premium. The example of that solution is the UK where is introduced combined system for the PV technologies and in Italy where in combined system small project are supported. Moreover additional solution can be introduced on national level like e.g. in Finland. There the government devised grants and subside system for less mature technologies. [43]

Tax incentives or exemptions

Tax incentives and exemptions system is introduced in countries like Spain, the Netherlands, Finland and Greece. This is powerful and flexible instruments to support selected the RES technologies and allow for impact on selected participants. It is one of the best solution for combined system with other options. A bit different solution is introduced in Poland, Latvia, Slovakia, Sweden and the UK. There production tax incentives are devised what provide to income tax deduction or credits at a set rate per unit of produced “green energy”. Hence the operation costs are lower and investment become competent. [43]

Fiscal incentives

That support instrument function in Germany, Netherlands, Bulgaria, Estonia, Poland and Malta. Fiscal incentives consist in soft or low interest loans for the RES technologies. In case of that loan the rate is lower than the market rate of interest. Moreover it allows for other concessions to borrower, including longer repayment periods or interest holidays. [43]

Tenders

Tenders system is provided in the Netherlands, the UK, Denmark and Spain. It is usually used for support large scale project like off shore wind farms. [43]

Below figure shows which of all described support instruments operate in each the EU member states: [43]

-

Description of technology|

Economic aspects|

Environment and public awareness|

Legislation|

Final comparison|

References