ECONOMICS

Cost's estimation

Own analysis based on EU method

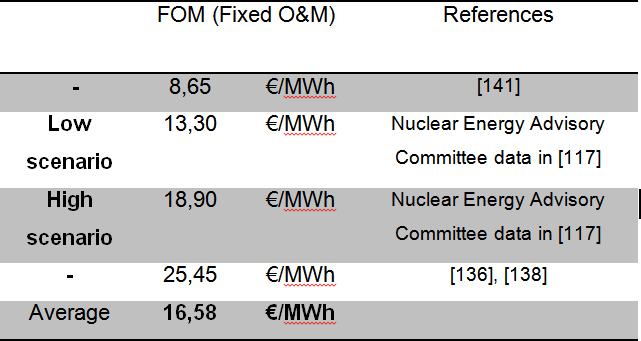

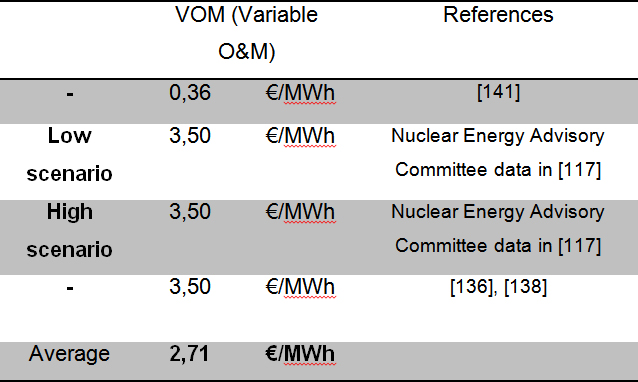

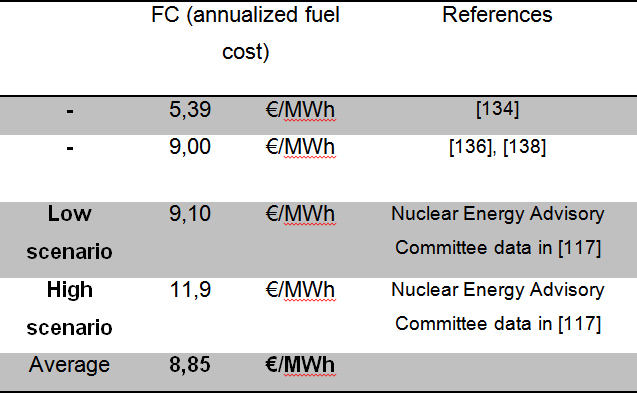

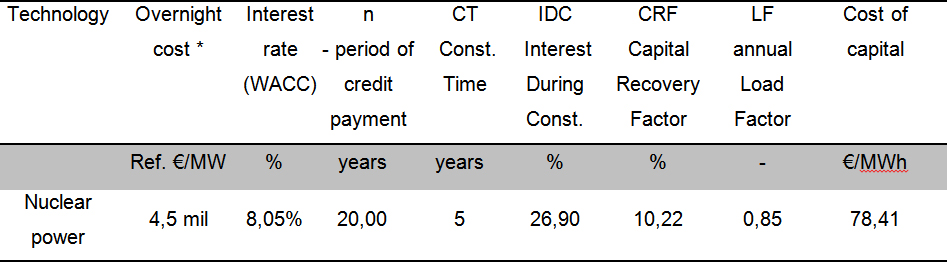

Attempt of nuclear energy cost estimation, carried out in this provision, is based on method proposed by the Commission of The European Communities [146]. UE study brought results that are not actual today. All prices were according to money value from year 2005. Moreover assumptions that had been made, are not proper today. Especially, overnight cost has increased significantly in recent years. Moreover, study assumed that credit payment would be carried through all lifetime of facility. Such attitude can be correct according to specific form of financing, but undoubtedly it is not in case of commercial bank credit granted to the investor. Estimation has been prepared without costs of decommissioning and nuclear wastes management. The levelized electricity cost was calculated according to most recent data about overnight cost, fixed and variable operating cost and fuel cost. Commercial bank credit for investor was assumed as the source of financing. Financial leverage, ratio of the bank credit value to cost of the investment, was set to 0,7. Additionally, bank loan can not be granted for longer than 25 years, where 5 years are construction time and 20 years - period of credit payment. Below assumptions of Fixed and Variable Operating & Maintenance costs and Fuel Cost are presented. Values refer to annualized costs during the nuclear power plant lifetime.

Source: K. Z m i j e w s k i, "Analiza Narodowego Programu Energetyki Jadrowej", Heinrich Böll Stiftung Warszawa, 2010, http://www.boell.pl/downloads/Analiza_Narodowego_Programu_Energetyki_Jadrowej.pdf , [117] W . M i e l c z a r s k i "Elektrownie atomowe - Obliczenia kosztów", "Energetyka cieplna i zawodowa" , 10/2009, [136] W . M i e l c z a r s k i "Kosztowna energetyka jadrowa", "Energetyka", 10/2010, [138] "Prospecting for Power: The cost of meeting increases in electricity demand", United States Carbon Sequestration Council, May 2010, [141]

Source: Own development, data source: K. Z m i j e w s k i, "Analiza Narodowego Programu Energetyki Jadrowej", Heinrich Böll Stiftung Warszawa, 2010, http://www.boell.pl/downloads/Analiza_Narodowego_Programu_Energetyki_Jadrowej.pdf , [117] W . M i e l c z a r s k i "Elektrownie atomowe - Obliczenia kosztów", "Energetyka cieplna i zawodowa" , 10/2009, [136] W . M i e l c z a r s k i "Kosztowna energetyka jadrowa", "Energetyka", 10/2010, [138] "Prospecting for Power: The cost of meeting increases in electricity demand", United States Carbon Sequestration Council, May 2010, [141]

Source: Own development, data source: K. Z m i j e w s k i, "Analiza Narodowego Programu Energetyki Jadrowej", Heinrich Böll Stiftung Warszawa, 2010, http://www.boell.pl/downloads/Analiza_Narodowego_Programu_Energetyki_Jadrowej.pdf , [117] W . M i e l c z a r s k i "Elektrownie atomowe - Obliczenia kosztów", "Energetyka cieplna i zawodowa" , 10/2009, [136] W . M i e l c z a r s k i "Kosztowna energetyka jadrowa", "Energetyka", 10/2010, [138] "Economics of new nuclear power plants", http://en.wikipedia.org/wiki/Economics_of_new_nuclear_power_plants , [134]

Source: Own development

In this estimation, overnight cost is used and it relates to EPC cost with owner's cost included (and without financing cost). According to Table no.6, and "Major cost's analysis" , assumption of 4,5 mil eur/MW seem to be proper and undoubtedly it is not overestimated. Interest rate is calculated with assumption that own equity is 30 % and loan equity 70 % of all investment cost. Loan equity interest is 7% and own equity interest is 1,5 times higher - 10,5 %. Based on these data, Weighted Average Cost of Capital (WACC) is 8,05 %. Bank credit is granted for 25 years. 5 years construction time is normally assumed by reactors producers ("Major cost's analysis"). Credit payment is started after construction finishes. Load factor is set on 0,85. Units with the best organizational schedule can reach 0,91 - 0,93 but majority of facilities operate with 0,85 load factor. This value is also assumed in [146], that this calculation is based on. Interest during construction (IDC) and capital recovery factor (CRF), are calculated with following formulas:

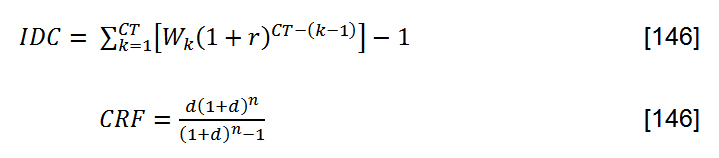

Where CT - construction time, Wk - part of total capital invested in k-year, r - interest rate (WACC), n - period of credit payment, d - discount rate ( equal to WACC). The cost of electricity (COE) is calculated:

Source: Own development

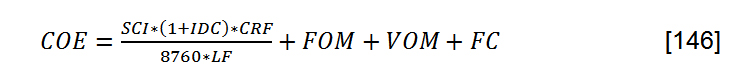

End calculation with FOM, VOM, FC cost (Table no. 7,8,9) is presented in Table no. 11. It presents busbar costs of electricity generated in nuclear power plant. The electricity price over 105 eur/MWh is high and significantly higher than from old nuclear units in the USA of France. Those construction were less expensive. Moreover many additional costs elements were arisen in development process (for example improved security cost). However the results obtained are at similar level as the latest published reports ("Major cost's analysis").

-

Nuclear power industry|

Technology|

The electricity supply system aspect|

Economics|

Environment|

Public aspect|

Future|

Legislation|

References|