- < 1|2 >

WHITE CERTIFICATES

THEORETICAL BACKGROUND

The Directive 2006/32/EC on energy end-use efficiency and energy services was initialized. It obligated the Member States to:

• provide suitable systems of incentives causing the growth of energy efficiency.

• identification and elimination of obstacles in growth of energy efficiency.

• guarantee the growth of electric market for end customers.

• guarantee the availability of energetic surveys.

• implement the market systems causing the growth of energy efficiency.

It also defines the national goal which is a reduction of years energy usage by 9% which has to be achieved after nine years after the implementation of the Directive. The main tool mentioned in the following Directive is White Certificate scheme. The Directive does not provide any details concerning system of white certificates thus the Member States have carte blanche on that field.

DIAGNOSIS

The investor who is interested in obtaining the white certificates for the modernization is obligated to recognize prospective savings which are the result of the planned development. To that end it is essential to perform an audit which will ex-ante intimate the expected profits and appoint the anticipated payback time. If the calculations in the audits are overdrawn and a company gets white certificates based on false figures the company will be obligated to pay penalties. This is why it is desirable for the investors to require the liability insurances from the auditors. The Directive states that the white certificates will be necessary for the companies responsible for distribution of energy only, which means that the distribution companies will be the only one companies in energy sector forced to collect the certificates in order to reemission. However some countries such as Poland do not only have much losses in the transmission and distribution system but also inefficient generating sector. This is why some of the countries are willing to extend the white certificate scheme to the others sectors.

CALL FOR TENDERS

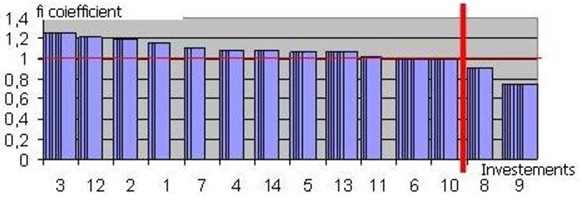

At least once a year the central office responsible for regulation of national energy market will carry out the call for tenders for a certain number of white certificates. Every certificate will be equal to the specific number of saved primary energy in tones of oil equivalent (toe). The specific form of conversion, whether it will be 1 or 100 white certificates for 1 toe reduced per year or per 10 years, it all depends on the Member States. The call for tenders will be won by the investors whose surveys forecast the highest ? coefficient where ? is a ratio of value of the white certificate to the value of the savings. Graph 13 presents hypothetical ? coefficients of investors who participated in the call for tenders. As can be seen the winners were the investors whose ? was higher than 1.

TURNOVERS

Once the company won the call for tenders it possesses white certificates which can be in form of a paper or a certain register in the central regulation office depending on the country. The company which owns the certificates can either sell them or collect them for redemption. The certificates can be sold on the stock exchange or on the OTC market where they will be treated as the securities.

- < 1|2 >

-

Definition of energy conservation and demand side management|

Technologies|

Financial funds|

Legislative and normative issues|

Data base

Copyrights © Arkadiusz Mysiakowski